Oh great news! The central banks have agreed to ramp up their “swap lines” so they can provide even more US dollars to global markets. And, to make it even more exciting, they’re going to increase the frequency of 7-day operations…to DAILY! Woohoo! Get ready for more liquidity backstops and easing of funding market strains. Because what the world really needs is more credit for households and businesses! Can’t wait until Monday, March 20, 2023 when this thrilling change takes effect. Yawn.

For Real

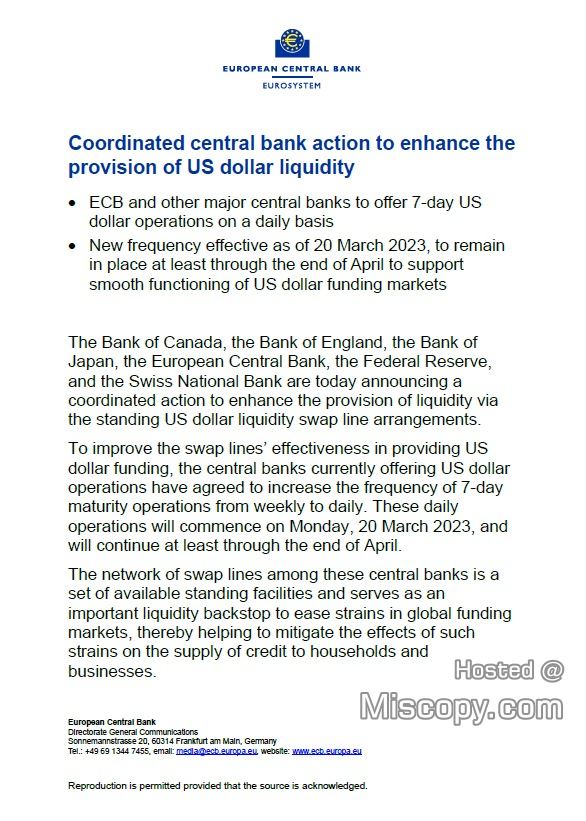

On March 23rd, 2023, the European Central Bank (ECB) announced that it will participate in a coordinated central bank action to enhance the provision of US dollar liquidity. The move is aimed at addressing potential funding strains in the US dollar funding markets, which could arise due to a variety of factors such as market stress, geopolitical tensions, or other uncertainties.

The coordinated action involves six central banks, including the ECB, the US Federal Reserve, the Bank of England, the Bank of Japan, the Swiss National Bank, and the Bank of Canada. These central banks will take steps to enhance their existing bilateral swap arrangements, which allow them to exchange their respective currencies and provide liquidity to their counterparties. Specifically, the central banks will increase the frequency of their swap operations from weekly to daily, and will also expand the range of eligible collateral that can be used in these transactions.

The move by the central banks implies the growing instability of the US dollar funding markets. These markets are a critical source of funding for many financial institutions, including banks, hedge funds, and other market participants. These funding markets have clearly become disrupted, which can have serious implications for financial stability and the wider economy.